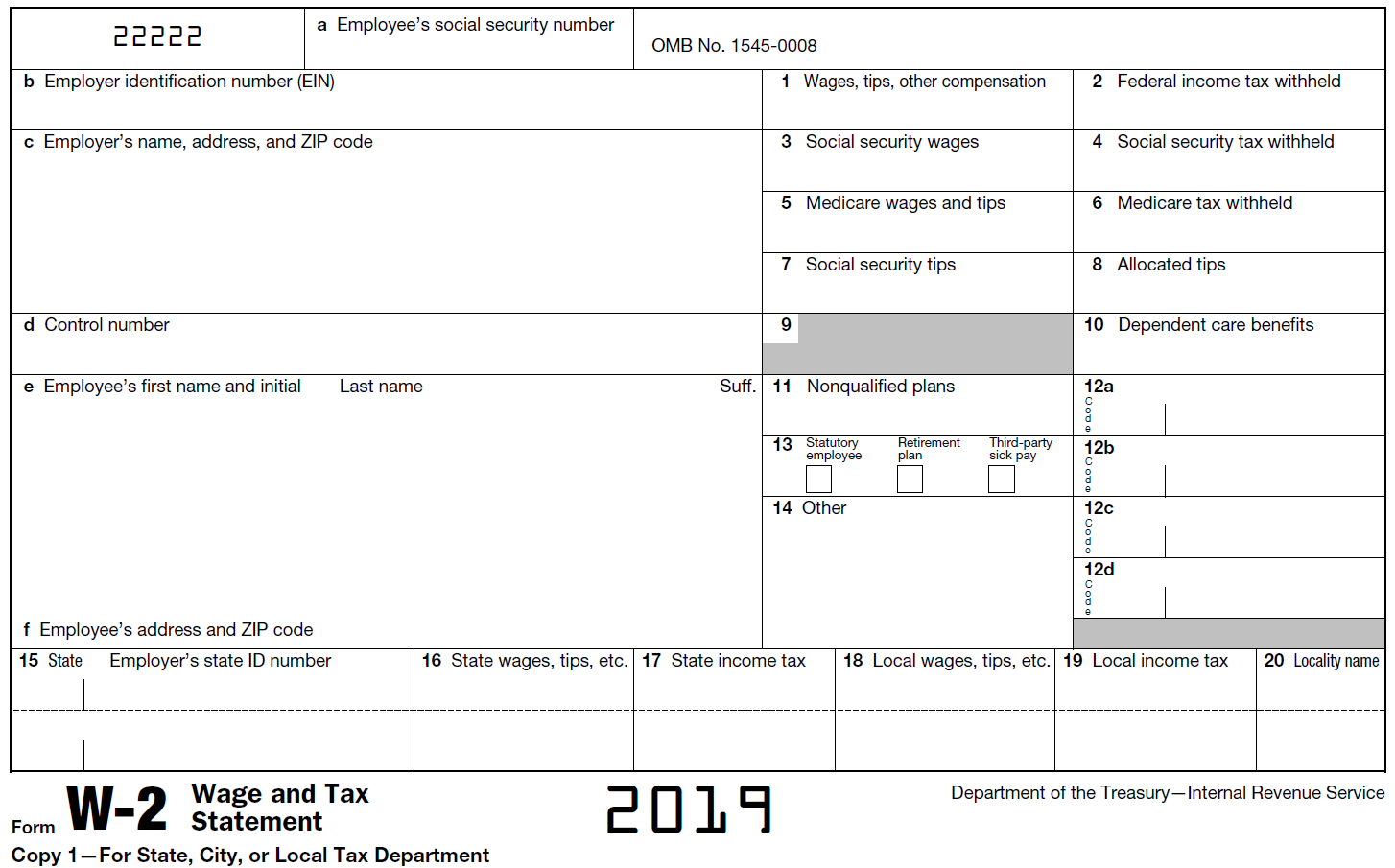

11 Nov How to Decode Box 1 of Form W-2

Box 1 of Form W-2 shows the employee’s total compensation that is subject to taxation for the year. Per an article published by Forbes, “This tends to be the number most taxpayers care about the most.” Consequently, there’s no room for error.

Below are inclusions and exclusions for Box 1 plus a brief explanation of the difference between Box 1, Box 3 and Box 5.

Inclusions

All taxable wages, tips and other compensation should go in Box 1. This includes:

- Hourly earnings, including overtime and premium pay, and salaries.

- Vacation, sick, PTO and holiday pay.

- Bonuses, commissions, prizes and awards.

- Noncash payments, such as taxable fringe benefits.

- Tips the employee reported to the employer.

- Business expense reimbursements made under a nonaccountable plan.

- Accident and health insurance premiums for 2%-or-more shareholder employees if the company is an S corporation.

- Taxable cash benefits under a Section 125, or cafeteria, plan.

- Employer and employee contributions to an Archer Medical Savings Account.

- Employer contributions for qualified long-term care if coverage is provided through a flexible spending arrangement.

- Group-term life insurance that exceeds $50,000.

- Taxable education assistance payments.

- Any amounts you paid toward the employee’s portion of Social Security and Medicare taxes.

- Designated Roth 401(k), 403(b) and 457(b) contributions.

- Payments to statutory employees who are excluded from federal income tax withholding but not from Social Security and Medicare taxes.

- Insurance protection cost under a compensatory split-dollar life insurance arrangement.

- Taxable employer and employee health savings account contributions.

- Taxable amounts paid to a nonqualified deferred compensation plan.

- Taxable moving expenses and expense reimbursements.

- Compensation made to former employees who are on active military duty.

- All other forms of taxable compensation, such as fellowship grants and scholarships.

Exclusions

Box 1 should not contain:

- Expense reimbursements — such as for transportation, lodging and meals — made under an accountable plan.

- De minimis fringe benefits. These are occasional benefits with a value no more than $100.

- Pretax contributions made to a retirement plan.

- Pretax benefits, such as health insurance, flexible spending account and HSA offered under a Section 125 plan.

- Other nontaxable wages and pretax benefits.

Difference between Box 1, Box 3 and Box 5

- Box 1 = Total taxable wages for the year.

- Box 2 = Total federal income tax withheld from Box 1.

- Box 3 = Total wages subject to Social Security tax.

- Box 4 = Total Social Security tax withheld from Box 3.

- Box 5 = Total wages subject to Medicare tax.

- Box 6 = Total Medicare tax withheld from Box 5.

The total wages for Box 3 and Box 5 may differ from the amount in Box 1 because not all taxable wages are subject to the same taxes. For example, some wages are subject to federal income tax but not to Social Security and Medicare taxes, and vice versa. To accurately compute Box 1, Box 3 and Box 5, you must know which federal taxes should be withheld from the taxable wage in question.